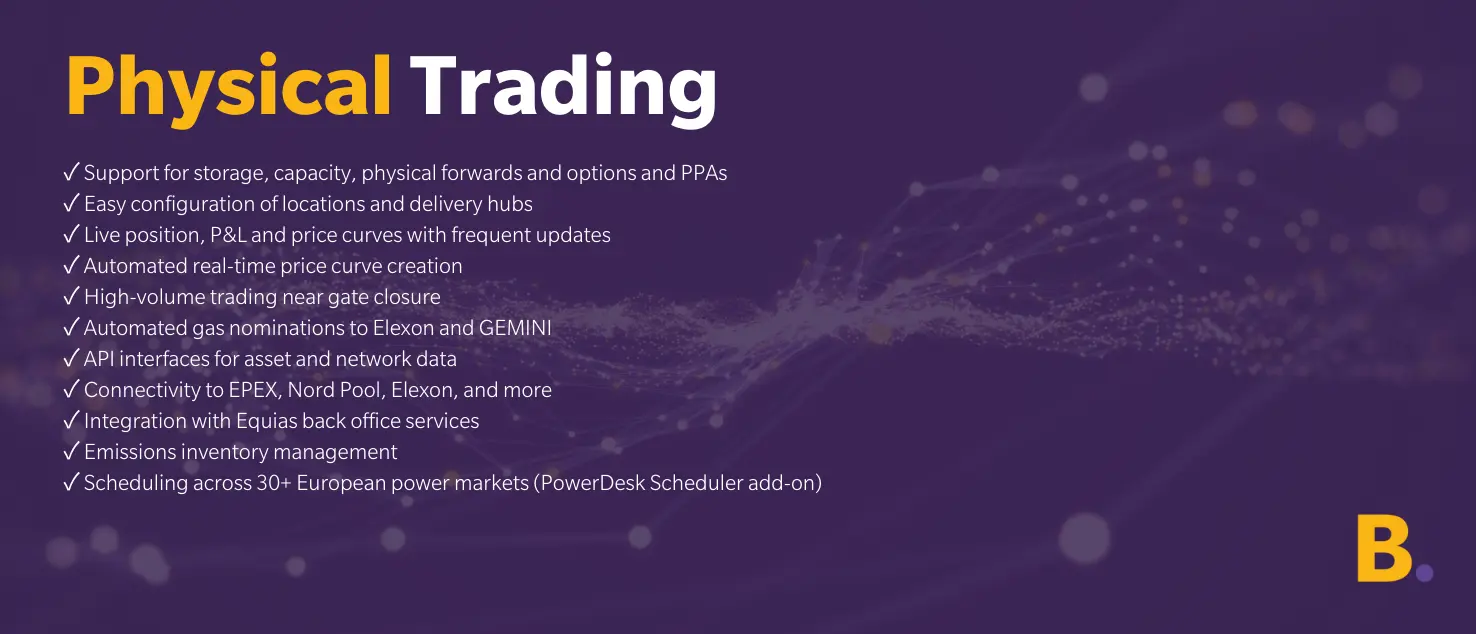

High performance C/ETRM SaaS

Revolutionise Energy Trading with Igloo

Developed with top-tier financial energy trading expertise, Igloo offers a state-of-the-art user experience. Its pre-configured core functionality ensures you can be operational in weeks with minimal capital expenditure.

Igloo caters to a diverse range of market participants, from investment funds and energy trading companies to utilities and asset developers. Whether you need standard ETRM functionality or advanced algorithmic trading execution, Igloo maximises your team’s productivity.

Investment Managers

SMAs

Power Markets

Financial & physical

Other Commodities

Financial trading

“We selected Igloo as their modern, cloud-based ETRM architecture provided powerful functionality as standard and the team has decades of ETRM delivery experience.”

Lee Priestly

Commercial Director

BRADY ENERGY INSIGHTS

The Future of

Energy Trading &

Risk Management

Looking towards 2030

Schedule a consultation demo with Brady today

If you would like to schedule a consultation or book a demonstration, please fill in this form and we’ll get back to you shortly.